Property Coverage

You’ve made a considerable investment into equipment, furnishings, supplies, and likely “improvements and betterments”.1 Improvements and betterments, or sometimes called “build outs”, include the pre-opening construction items like partition walls for treatment rooms, floor and wall coverings, permanently installed equipment and fixtures that weren’t already there (like sinks and counters in treatment rooms). Everything is perfect…. Now what?

Property insurance coverage will include your “business personal property” (that’s insurance speak for everything listed above) and your building (if you’re the owner). Coverage varies from policy to policy but will ordinarily insure against all perils except those that are specifically not covered.2 These are the policy “exclusions” and should be carefully reviewed with your insurance agent before you purchase the policy. Many property insurance policies also include a host of coverage enhancements such as coverage for theft of money, back-up of sewers and drains, glass and signs, and business interruption coverage. Business interruption insurance protects against loss of business income resulting from a covered loss at your location such as fire. Coverage normally includes ongoing expenses, payroll, and loss of net income.

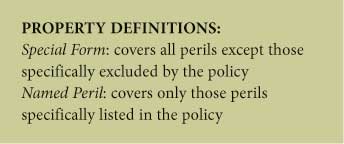

When purchasing property insurance, opt for “special form” coverage (side bar). The policy should also provide coverage on a “replacement cost” basis. Replacement cost policies pay claims based on the actual cost to replace the damaged or destroyed property without deducting depreciation.

General Liability Coverage

General liability coverage is often sold as a package policy with property coverage. Whether sold as a package or a stand-alone policy, the coverage is the same. General liability coverage protects against lawsuits arising out of the operation of your business. Policies normally include trip and fall accidents, product liability, allegations that your business has committed libel, slander, and trademark infringement,3 and fire legal liability. Fire (or tenant’s) legal liability coverage protects you against lawsuits arising out of damage caused by your business to the premises rented to you. For example, this would cover damage to building from a fire caused by unattended candles in the spa. General liability policies normally exclude intentional acts (like assaulting a customer), professional liability (malpractice), and workers’ compensation. As with property insurance, the policy exclusions impact coverage tremendously and should be reviewed with your insurance agent.

Commercial Automobile Coverage

If your business owns any vehicles, a commercial automobile policy would be appropriate. The coverage is nearly the same as your regular personal automobile policy. You should remember however, that even businesses that don’t own any vehicles may still have some exposure to an automobile liability claim. Any time you rent or borrow a vehicle for business use, or send an employee on a business errand in your own vehicle, there is a chance that an accident could occur. If the accident happens on company business, your spa could be held liable for the resulting injuries and/or property damage. Businesses without any owned vehicles should give consideration to the purchase of hired and non-owned automobile liability coverage. In some cases, coverage is also available to insure damage to rented vehicles. Hired and non-owned automobile liability coverage is generally inexpensive and is often an optional coverage on a general liability policy.

Professional Liability Coverage

Professional liability or “malpractice” coverage4 is possibly the most important, least understood, and may likely be the most expensive component of your insurance program. Simply put, professional liability coverage insures against injuries caused by your performing or failure to perform your professional services. Injuries could include burns from a laser or chemical peel, allergic reactions to skin preparations, muscle injuries from a massage, or an infection at an injection site (etc.). The list of potential causes of a professional liability claim is endless.

Where property and general liability policy coverage is fairly standardized, professional liability policies vary greatly by the way of coverage and price. It is critical that your insurance agent have a clear understanding of your business and the proposed insurance policy—if either is incomplete, there could be major problems waiting just around the corner. There are a relative few insurance agencies that truly specialize in coverage for medical spas. For better or worse, the explosive growth in spa industry has attracted a large number of inexperienced insurance agents. Be sure that you’re selecting a professional with a broad knowledge of your industry and of the proposed insurance policies.

There are a few critical factors to consider when navigating the purchase of your professional liability coverage. These factors include who is covered, what services are covered, cost of defense, coverage form, and quality of insurer.

The malpractice coverage carried by many doctors provides coverage only for the doctor and/or the doctor and their staff. In order to be fully covered, you’ll need a policy that covers service rendered by you and your staff as well as your business (corporation, LLC, etc.). Protecting yourself against claims is important, but it won’t be of much help if your business is bankrupted by an uninsured lawsuit. Also, understand that independent contractors may not be covered under your policy. If so, they should provide you with evidence of their own insurance coverage. Evidence of coverage is ideally in the form of a “certificate of insurance” that includes your name and address as “certificate holder”. As “certificate holder”, the insurance company will notify you if the policy is cancelled during the year. For better protection, I recommend that policies covering independent contractors should name the spa as an “additional insured”. “Additional insured” status is the same as “certificate holder” with one major benefit: if the spa is sued as a result of services rendered by an independent contractor, the “additional insured” spa would be covered under the independent contractor’s policy. Many policies for aestheticians, massage therapists, and non-medical laser technicians will cover “additional insureds” at little or no cost. Nearly all policies for medical doctors and nurses will refuse to add any “additional insureds”. As such, it is important to understand that inviting doctors (and sometimes nurses) to work at your spa as independent contractors will expose your spa to an uninsured claim.

After you’ve worked out who will be covered under your professional liability policy, it’s time to sort out what services are insured. As I mentioned earlier, each insurance company has their own particular method of describing what’s covered and what’s not. Some policies will insure specifically listed services, while others include coverage for broad categories of services. When applying for professional liability coverage, be sure that your insurance application is as complete as possible. Make certain that the insurance carrier has seen your entire menu of services. Whether your policy provides coverage for specific services or broad categories of services, it is recommended that you advise your insurance agent of any new services added during the course of the year. Sure the new injectable filler works great, but is it covered?

When everything is said and done, professional liability policies are there to defend against lawsuits. The cost of your defense can sometimes exceed the settlement awarded. There are two primary methods in which insurance policies deal with coverage for the cost of your defense. We call them “defense outside limits” and “defense inside limits”. If a choice is available, you’ll want to select the former rather than the latter. A $1,000,000 policy with defense “outside limits” will pay up to $1,000,000 to the injured person and 100 percent of the cost of your defense. The same policy written with defense “inside limits” will deduct the cost of defense from your policy limit before paying your claim. Defense costs for a major malpractice claim could easily reach $100,000. If the claimant is awarded a $1,000,000 payment, you’ll be left to make up the difference. I recognize that not every claim will result in a $1,000,000 award. I also recognize that many professionals carry substantially less that $1,000,000 coverage. The lower your coverage limit, the more this distinction could impact you.

Professional liability policies are written on one of two basic coverage forms. The first is called “occurrence form”. The second is called a “claims made” form. Coverage under occurrence form policies is triggered by the date the injury occurred—if the injury occurred while coverage was in force, the coverage applies. Coverage under claims made form policies is triggered by the date the claim is made—coverage applies only if coverage is still in force when the claim is reported to the insurance company. If you must carry a claims made form professional liability policy, be sure that you understand the implications and cost of “tail coverage”. Tail coverage5 extends the amount of time allowed to report claims beyond the policy expiration date in one year increments. The cost and availability of tail coverage varies tremendously between different insurance companies. It’s a good idea to review the costs of tail coverage prior to purchasing any claims made form professional liability policy.

Workers’ Compensation and Employer’s Liability6

Workers’ compensation insurance covers your employees for medical bills and lost wages resulting from on the job injury or disease. All states require businesses with employees to carry workers’ compensation coverage in some form. In most states, business owners choose whether or not to cover themselves. Coverage and reimbursement rates for medical bills and lost wages are separately set by each state.

The employer’s liability section of coverage protects your business against third party lawsuits arising out of workplace injury. Thanks to the presence of workers’ compensation law, injured employees are generally unable to sue their employer for on the job injuries. However, spouses of injured employees and/or those whom rely on the injured employee for support or care can sue.

The actual coverage provided under a workers’ compensation and employer’s liability policy is the same, regardless of insurance carrier. These policies vary only in price. Premiums are based on a percentage of estimated annual wages for the business and include a variety of state taxes and fees. At the end of each policy period, the insurance company conducts a payroll audit and adjusts the prior year’s premium upward or downward accordingly.

Employment Practices Liability

Employment practices liability insurance (“EPLI”) protects against lawsuits alleging wrongful termination, sexual

harassment, hostile work environment, and the like. We are seeing an increase in this type of legal action and expect the trend to continue. While EPLI can be expensive, even a groundless suit can cost in excess of $25,000 to defend. All businesses with employees should consider EPLI coverage.

Umbrella or Excess Liability7

The previously mentioned liability policies are called primary or underlying policies. These policies provide your first layer of defense against lawsuits. Umbrella or excess liability policies provide additional layers of coverage in $1,000,000 increments. We’ve all heard the old saying that you “can never be too thin or too rich”. I’d like to add that you “can never have too much liability insurance”. Umbrella policies are generally less expensive than the underlying policies, and are a cost effective method of protecting your business assets against underinsured lawsuits.

Risk Management

An effective combination of insurance policies is only one component of your risk management program. In addition to insurance coverage, you will need to consider a variety of loss control measures including effective safeguarding of property (such as quality locks, alarms, and sprinkler systems), careful patient intake procedures (including appropriate consent/release, medical history forms, and post-treatment instruction forms), and human resources procedures (employment handbooks, performance reviews, etc.). By eliminating hazards before a claim occurs, you will be able to control your insurance costs, as well as your exposure to loss.

Consider your insurance agent a partner in the success of your business. Choose a professional whom you trust, and whom also understands your business as well as their own.

(Endnotes)

1 If you own your building, “improvements and betterments” should be included in the value of the building for insurance purposes.

2 This is called “special form” coverage, and is the preferred type of property insurance. Alternatively, “named peril” coverage insures only against those perils specifically listed in the policy.

3 Your insurance agent will call these allegations “personal and advertising injury”.

4 While coverage for doctors and nurses is most commonly called “malpractice”, the terms “professional liability”, “malpractice”, and “errors and omissions” all refer to the same type of coverage.

5 Tail coverage is sometimes referred to as an “extended reporting period”.

6 Certain states (N.D., Ohio, Wash., and Wyo.) treat workers’ compensation and employer’s liability coverage differently. Consult your insurance agent.

7 There are slight differences in “umbrella” and “excess” liability not pertinent to our discussion. Consult your insurance agent.

R. Charles Stevens II CISR manages the specialty programs division at Marine Agency Corporation in Maplewood, N.J. Stevens has specialized in the insuring the beauty industry for over 12 years, and is a recipient of the Certified Insurance Service Representative designation. Marine Agency Corporation provides customized policies in all 50 states for medical and anti-aging spas, cosmetic laser and IPL clinics, day spas and salons, massage therapists, aestheticians, electrologists, micropigmentation technicians, tattoo/body piercing studios, and compounding pharmacies. Stevens is available to answer questions by e-mail at This email address is being protected from spambots. You need JavaScript enabled to view it..

Want to read more?

Subscribe to one of our monthly plans to continue reading this article.